How Much Is The Child Tax Credit In New York State

How much is the credit. In contrast couples with no dependent children earning less than 21920 can receive no more than 543.

Wsj News Graphics Wsjgraphics Graphic Information Graphics Tax Credits

For information on qualifying for the federal credit see federal IRS Publication 503 Child and Dependent Care Expenses.

How much is the child tax credit in new york state. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Your amount changes based on your income. Over 19 million families in New York will get a check in July. The payment for children.

You may claim the greater of. 100 multiplied by the number of qualifying children. Child and dependent care credit New York State New York City College tuition credit.

Applies to children at least four years old who qualify for the federal child credit. An eligible New Yorker receives 2400 on average. The NYC Child Care Tax Credit is another tax benefit to help families pay for childcare.

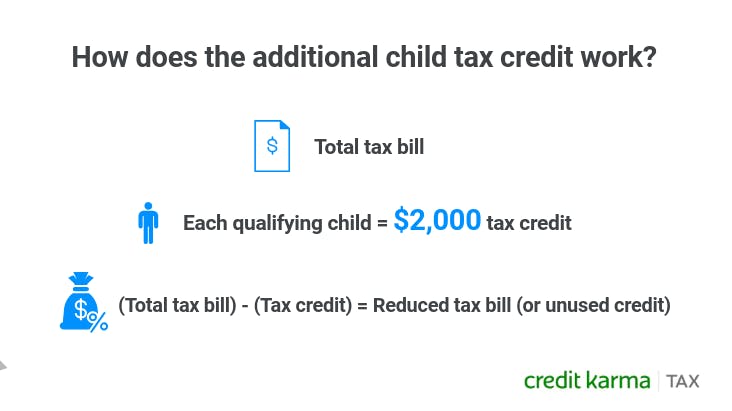

20 of the federal EIC that you could have claimed based on your NY recomputed FAGI and recomputed earned income if the. The amount refunded from the Child Tax Credit can only be equal to 15 of your total earned income above the limit of 2500. If you did not claim the federal child tax credit but meet all of the other eligibility requirements shown above the amount of the Empire State child credit is.

The amount is capped and your income will play a role in this. Have paid at least the court-ordered amount of child support during the tax year. Children must be under age 13.

The child tax credit limit is locked in at 2000 per child. The credit is computed based on the amount of your New York State adjusted gross income the number of qualifying persons and the amount of qualified expenses paid. You should also keep in mind that the child tax credit begins to phase out at 200000 for single taxpayers and 400000 for joint taxpayers.

You will also need to file Form IT-216 including required provider infomationline 2. EITC can provide a tax refund of up to 8991 combined Federal State and City. Household credit New York State New York City Noncustodial parent earned income credit.

Individuals and families. Size of Empire State Child Tax Credit For New York State taxpayers who claim the federal child tax credit the Empire State child credit is 100 for each child or 33 percent of the federal credit whichever is greater. In the enhanced Child Tax Credit families can receive an advance cash benefit on the credit through monthly payments of 250 to 300 per child set to begin July 15 2021.

Is the credit refundable. Earned income credit New York State New York City Empire State child credit. Taxpayers who dont claim the federal credit can claim 100 for each child.

The Child Tax Credit is a major tax credit for those with children. What is the Child Tax Credit. If your or your childs SSN or ITIN was issued after the due date of the return you may claim only 100 per qualifying child.

Families who earn 30000 or less and pay for childcare for children age 4 or under may be eligible for a credit of up to 1733. You claim the credit when you file your taxes. This has increased substantially under the Tax Cuts and Jobs.

The New York State child and dependent carecredit is a minimum of 20 and as much as110 of the federal credit depending on theamount of your New York adjusted grossincome. You will need to file New York Form IT-150 IT-201 or IT-203. The Child Tax Credit CTC is a tax credit for single or married workers earning low or moderate incomes who have dependent children under age 17.

Scroll to see what the Child Tax Credit means for families in the tri-state area. Empire State Child Credit - 33 of the federal child tax credit ot 100 for each qualifying child. New Yorks Empire State Child Tax Credit is a refundable credit for full-year New York State residents with children who qualify for the Federal Child Tax Credit and are at least four years of age.

Workers who qualify for the CTC and file a federal tax return can receive a credit of up to 2000 per child and a 500 nonrefundable credit for qualifying dependents other than children. How much is the credit. You may qualify for New York State Child and Dependent Care Credit a refundable tax credit of up to 2310.

What does this mean for New York families. The credit is meant for low- to moderate-income working individuals and couples particularly those with children. Nationwide approximately 89 of families with children are expected to receive tax credits this year with 35 million children benefiting in New York State alone.

Single parents with two children under age 19 who made less than 53865 are eligible for a refundable credit of up to 5980. The Federal Child Tax Credit and Additional Child Tax Credit are tax credits offered for taxpayers raising dependent children under the age of 17. Dependent Child Care Credit - 20 to 110 of your federal child credit depending on your New York gross income.

Expert Tips For Navigating The New Monthly Child Tax Credit Money

Five Facts About The New Advance Child Tax Credit

Two Education Credits Help Taxpayers With College Costs With School Back In Session Parents And Students Should Look Into Tax Credits College Costs Education

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

Child Tax Credit Turbotax Tax Tips Videos

Stimulus Checks Child Tax Credit Payments To Start July 15 How Much Will You Get Syracuse Com

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Child Tax Credit 2021 When Payments Start How To Opt Out

What Is A Tax Credit Vs Tax Deduction Do You Know The Difference Tax Deductions Tax Credits Money Apps

Biden S Monthly Child Tax Payment Calculator 2021 See How Much You May Qualify For Forbes Advisor

Child Tax Credit Enhancements Under The American Rescue Plan Itep

Lihtc Infographic Low Income Housing Infographic Tax Credits

Brooklyn Photo Studio Rental Studio Rental Film Studio Studio

Irs Child Tax Credit Payments Start July 15

Irs Child Tax Credit Portals Update Your Info Add Direct Deposit Details And More Cnet

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

What Is The Additional Child Tax Credit Credit Karma Tax

Child Tax Credit How Much Money Will The Irs Send You Each Month Cbs New York

Post a Comment for "How Much Is The Child Tax Credit In New York State"