Child Tax Credit Amount History

Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. This is a stylized example assuming the taxpayer has one qualifying child.

What Is The Child Tax Credit Ctc Tax Foundation

The Child Tax Credit like most tax credits has a phase-out at certain income levels.

Child tax credit amount history. Help is Here. Thats up to 7200 for twins This is on top of. The expanded credit was established in the American Rescue Plan signed into law in March.

For more information on the child tax credit including the 500 nonrefundable credit for non-child tax credit dependents see CRS Report R41873 The Child Tax Credit. 105-34 as a 500-per-child nonrefundable credit to provide tax relief to middle- and upper-middle-income families. You will claim the other half when you file your 2021 income tax return.

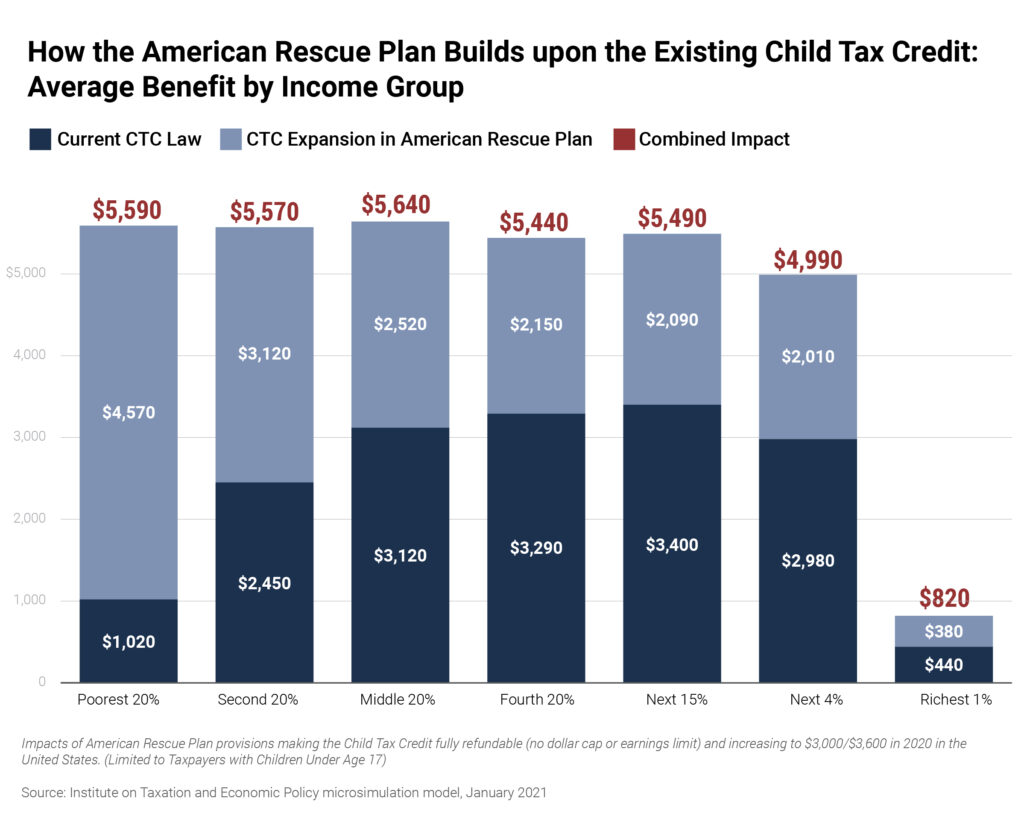

For those with children the American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children. For one year the Child Tax Creditwhich reduces income taxes families owe dollar-for-dollarwas expanded in the American Rescue Plan from 2000 per child to 3600 for children. Legislative History Congressional Research Service Summary The child tax credit was initially structured in the Taxpayer Relief Act of 1997 PL.

The Child Tax Credit. In 2021 the maximum enhanced child tax credit is 3600 for children. If the credit exceeds taxes owed families may receive the excess amount as a refund.

Data from the IRS indicate that the total dollar amount of the child tax credit has increased significantly since enactment from approximately 23 billion in 1998 to 118 billion in 2018 with the largest increase coming after the TCJA expansions as. For 2021 the Child Tax Credit provides a credit of up to 3600 per child under age 6 and 3000 per child from ages 6 to 17. The Child Tax Credit Amount by Income Level Note.

Some 90 of families with children are projected to receive an average credit of 2380 in 2020 according to the Tax. For an individual to be eligible for the Child Tax Credit the following six tests must be met. For income between 10540 and 19330 the tax credit is constant at 3584.

That means the credit will be paid. Equally important the Presidents proposal would make the credit fully refundable. The child tax credit was enacted as part of the Taxpayer Relief Act of 1997 as a 400-per-child credit which increased to 500 for tax years after 1998 and accounted for over 60 percent of the 10-year cost of the entire bill Joint Committee on Taxation 1997.

Child Tax Credit Awareness Day The American Rescue Plan delivered major tax relief for working families with children through a historic expansion of the Child Tax Credit. Until now the credit was up to only 2000 per child under age 17. How It Works and Who Receives It by Margot L.

These changes apply to tax year 2021 only. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. President Biden proposed increasing the child tax credit to 3600 for children under six and up to 3000 for children up to age 18.

Tax credit equals 034 for each dollar of earned income for income up to 10540. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

With one child and parent filing singly or as head of household. Tax Credit for case of one qualifying child. New parents are eligible for child tax credit payments Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Threshold for those entitled to Child Tax Credit only. Eligible families can claim a Child Tax Credit of up to 2000 per qualifying child. The credit will also be available periodically throughout the year starting as early as July rather than as a lump sum at tax time.

Child Tax Credit Enhancements Under The American Rescue Plan Itep

Irs Unveils Tool To Opt Out Of Monthly Child Tax Credit Payments

What Is The Child Tax Credit Ctc Tax Foundation

Fact Sheet Permanently Expand The Child Tax Credit To Reduce Child Hunger Bread For The World

Fourth Stimulus Check Summary 30 June 2021 As Com

Child Tax Credit 2021 Are You Eligible For The Extra Cash 3 Ways To Check Cnet

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Fact Sheet Permanently Expand The Child Tax Credit To Reduce Child Hunger Bread For The World

A New Child Tax Credit Would Put Us On The Road To A Stronger New Mexico New Mexico Voices For Children

Child Tax Credit Faq Everything To Know Before First Payment In 6 Days Cnet

Fourth Stimulus Check News Summary For Monday 12 July As Com

Post a Comment for "Child Tax Credit Amount History"