Child Tax Credit Letter 2021

The phaseout range for the Child Tax Credit for 2020 starts at modified adjusted gross income of 400000 for married filing jointly. Aside from having children who are 17 or younger as of December 31 2021.

Child Tax Credit 2021 Are You Eligible For The Extra Cash 3 Ways To Check Cnet

Another new development came on.

Child tax credit letter 2021. The maximum enhanced credit which was established by the American Rescue Plan in March is 3600 for children younger than age 6 and 3000 for those between 6 and 17 for 2021. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. It only applies to dependents who are younger than 17 as of the last day of the tax year.

Before 2021 the credit was worth up to 2000 per eligible child and 17 year-olds were not considered as qualifying children for the credit. Families will receive a maximum of 3600 for each child under 6 for tax year 2021 and a maximum of 3000 for kids 6 through 17. You will claim the other half when you file your 2021 income tax return.

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. As many as 92 of households with children will qualify for this direct economic aid under the American Rescue Plan which increased the child tax credit from 2000 to 3600 max per child. This means that eligible families can get it even if they owe no federal income tax.

July 13 2021 600 AM MoneyWatch The Child Tax Credit is slated to begin its first-ever monthly cash payments on July 15 when the IRS will begin sending checks to eligible families with. Every household with children that qualified for the latest. These changes apply to tax year 2021 only.

The expanded IRS Child Tax Credit applies per child up to age 17 as of December 31 2021. The child tax credit amounts change as your modified adjusted gross income agi increases. Under the new bill parents will get 3600 per child up to age six and 3000 per child ages 6 to 17.

The maximum annual tax credit per child was also increased from 2000 to 3600 for children under age 6 and 3000 for children between ages 6 and 17. The IRS plans to send a second letter to confirm eligibility and estimate how much child tax credit money you could receive or use our calculator to get. This years Child Tax Credit was expanded under.

Eligibility for the 2021 Child Tax Credit CTC advanced payments is determined by the information provided in your 2020 tax return or your 2019 return if this years return has not yet been processed. June 21 2021 Statements and Releases. Previously the refundable portion was limited to 1400 per child.

Previously the credit had excluded children who had turned 17 and was limited to 2000 per child. The letters are part of an ongoing effort from the Biden administration to better inform the American people about the hugely significant new programme. The rest of the credit can be taken on a taxpayers 2021 tax return.

As part of the American Rescue Plan Act that was enacted in March 2021 the child tax credit. For 2021 the child tax credit provides a credit of up to 3600 per child under age 6 and 3000 per child from ages 6 to 17. Statement by President Joe Biden on Child Tax Credit Awareness Day.

I have repeatedly said that Americas middle class deserves a tax. How much you get will depend on your income if you do qualify. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children between ages 6 and 17.

The entire credit is fully refundable for 2021. Before the recent changes it was limited to children up to age 16. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for.

This is the first. Amount has increased for certain taxpayers Is fully refundable meaning taxpayers can receive it even if they dont owe the IRS May be partially received in monthly payments.

Does That Irs Letter Bring Good News About Next Month S Child Tax Credit Payment Cnet

3 Easy Ways To See If You Qualify For Thursday S Irs Child Tax Credit Payment Cnet

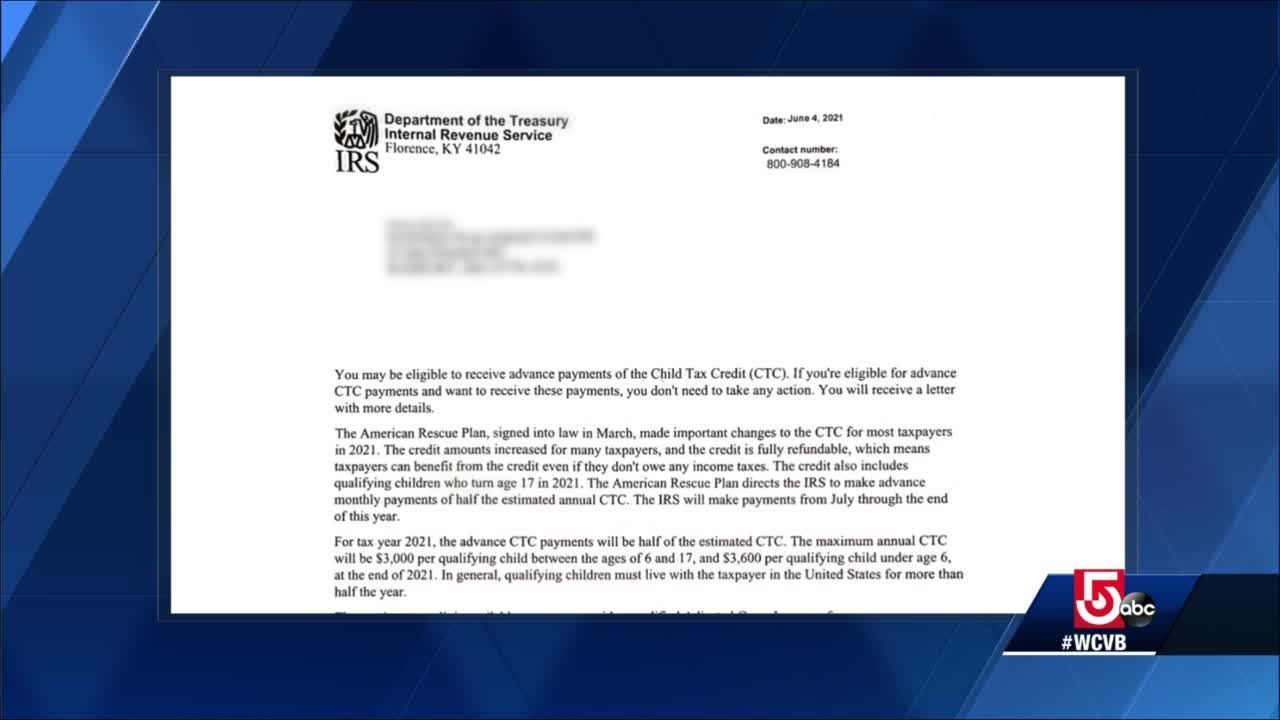

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

What Is A Cp05 Letter From The Irs And What Should I Do

I Have Received A Debt Letter From Hmrc Is It Real Low Incomes Tax Reform Group

Why Did I Get A Letter From The Irs

Have You Received An Additional Letter About Your Tax Credit Renewal From Hmrc Low Incomes Tax Reform Group

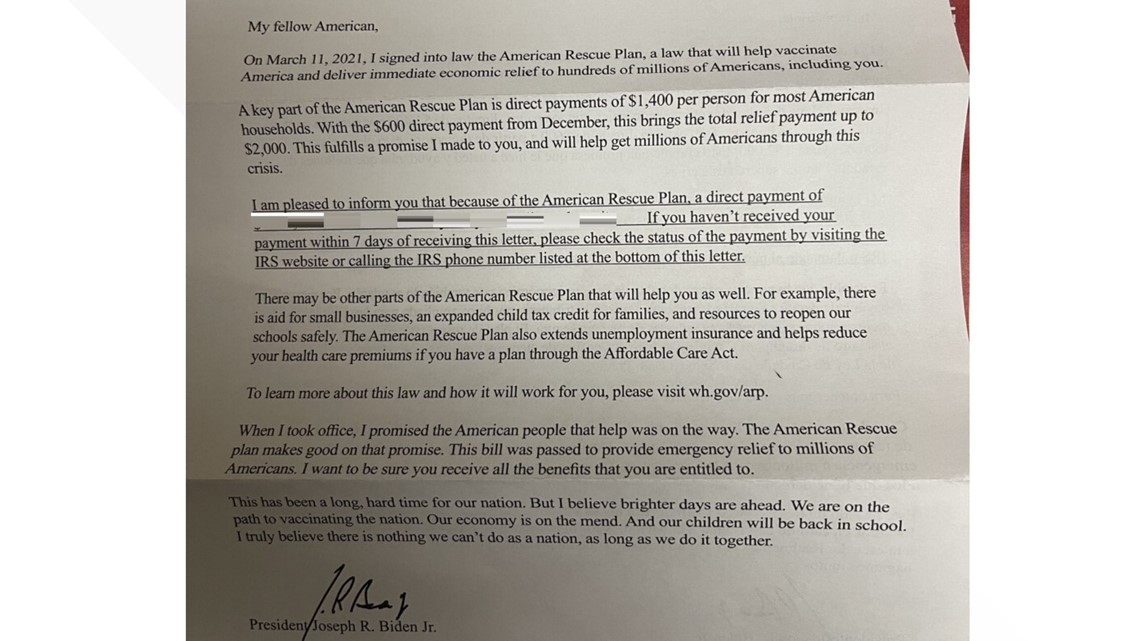

Why Did I Get A Letter From The Irs About The American Rescue Plan

Child Tax Credit Irs Mails Letters To Taxpayers About Advanced Payments Wane 15

Child Tax Credit 2021 Are You Eligible For The Extra Cash 3 Ways To Check Cnet

Stimulus Check 2021 Irs Says Letter From White House Outlining Stimulus Payments Not A Scam Abc7 Chicago

Libby Cathey On Twitter Internal Emails Obtained By Abc Give An Inside Look At The Scramble To Add Trump S Name Days Before Payments Started Going Out In The Middle Of An Election

Cordes Associates Posts Facebook

Stimulus Check 2021 Irs Says Letter From White House Outlining Stimulus Payments Not A Scam Abc7 Chicago

The Irs Is Sending Letters To People Who Ll Get The Child Tax Credit Next Month Nextadvisor With Time

Explaining Recent Irs Letters About The Child Tax Credit

Don T Panic If You Receive This Letter From The Irs

What You Need To Know About The Child Tax Credit In 2021 Forbes Advisor

Post a Comment for "Child Tax Credit Letter 2021"